Bahamas Enforced Regulatory Requirements

Bahamas Blacklisted, and its Enforced Regulatory Requirements

Brazil’s Lower House Approves Tax on Offshore Blocker

Brazil’s Lower House Approves Tax on Offshore Blocker

B.V.I, Bahamas, OtherCaribbean Jurisdictionsand OECD Minimum Global Tax

B.V.I, Bahamas, Other Caribbean Jurisdictions Vs. OECD Minimum Global Tax

BRAZIL’s TAX REFORM APPROVED IN LOWER HOUSE OF CONGRESS

BRAZIL’s TAX REFORM APPROVED IN LOWER HOUSE OF CONGRESS

The New Transfer Pricing in Brazil.

The Landing of the New Transfer Pricing Regulations in Brazil.

Brazil has published new transfer pricing (TP) regulations adopting the arm’s-length principle (Medida Provisória (MP) No 1.152).

Foreign Investment in Brazil

Foreign Direct Investment in to Brazilian entities report obligation & Relaxation on non-Resident Bank Accounts in Brazil

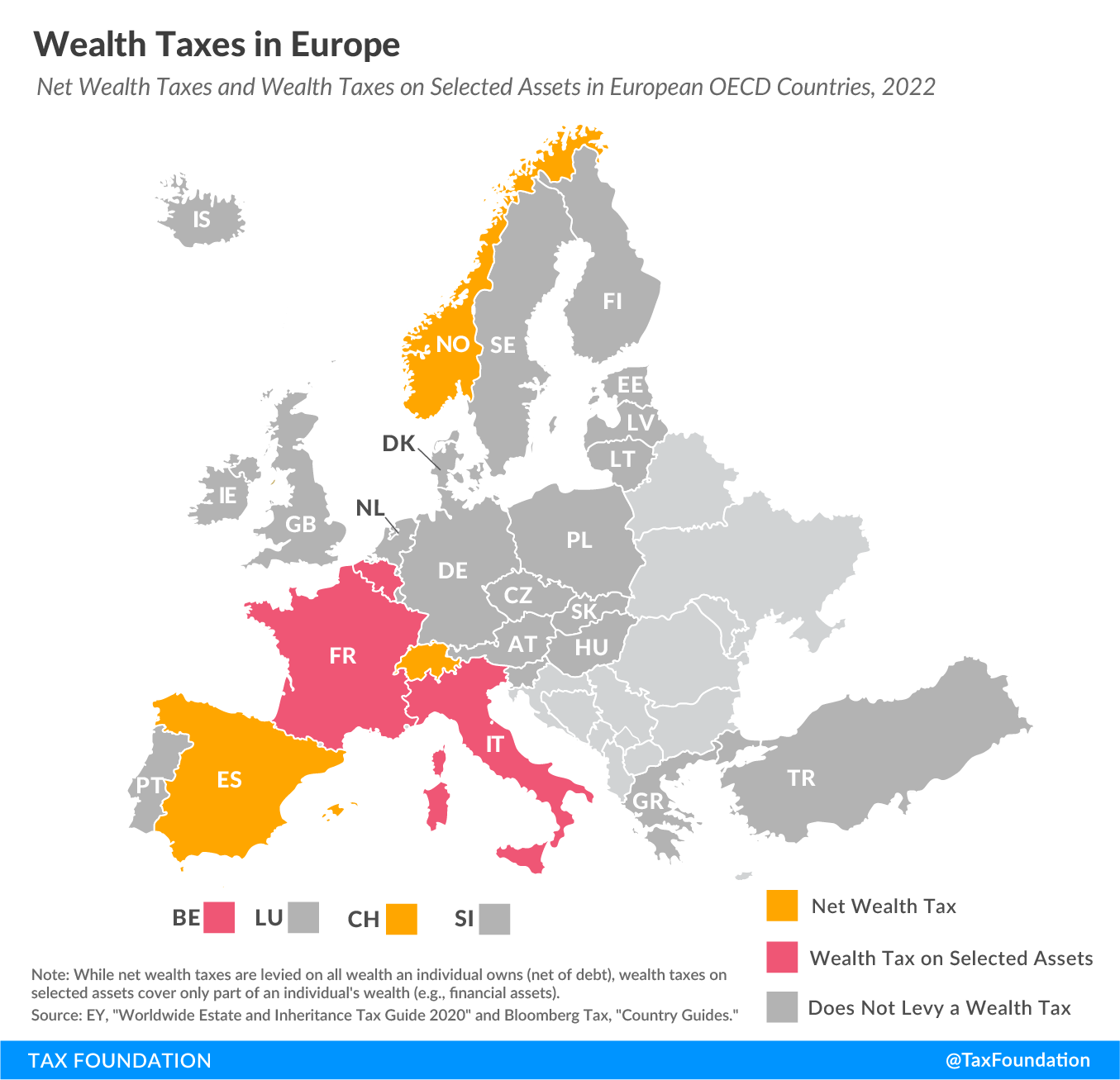

Spain’s Additional Wealth Tax Passed in Spain

Spain’s Additional Temporary Wealth Tax Passed through Spain’s Parliament on December 29 2022.

Foreign Tax Credits -The New Arm's Length Requirement

The U.S. Chamber of Commerce and its Brazil-U.S. Business Council has asked Treasury for the immediate withdrawal, suspension, or modification of the new arm’s-length requirement in final foreign tax credit regulations, claiming that it is unjustifiably over-broad and punitive and that it could cause lasting damage to U.S. commercial and economic interests.

Is Wealth Tax a trend in Latin America?

Spain’s Additional Wealth Tax on Taxpayers With $2.9 Million in Assets. Can Global Families Safely Navigate a Wealth Strategic Plan?

Navigating Biden’s Proposed Wealth Tax and theSunset of Estate Tax in 2025

Navigating Biden’s Proposed Wealth Tax and the Sunset of Estate Tax in 2025

May I Credit Taxes Paid in a Foreign Jurisdiction?

May I Credit Taxes Paid in a Foreign Jurisdiction?

Foreign Bank Account Reporting (FBAR) Violation

Foreign Bank Account Reporting (FBAR) Violation

Global Families Need Global Estate and Tax Planning.

Global Families Need Global Estate and Tax Planning.

Government’s Proposal on Crypto Reporting

President Biden’s fiscal 2022 budget includes proposals to enhance crypto reporting on foreign-held digital assets to boost transparency.

the 45-day 1031 Like-Kind Exchange Deadline

The 1031 Exchange Improvement Act allows taxpayers to roll earnings from real estate sales deferring its capital gain until the eventual sale of the ultimate property.

Can Wealthy Tax Help Countries Save Their Economy?

Can Wealthy Tax Help Countries Save Their Economy? Will Countries Continuously Increase Taxes on Wealth?

Independently of the outcome, the message is still the same: Plane Now.